Deutsche Bank says that the “exceptional” in America is the side damage of the Trump ID war.

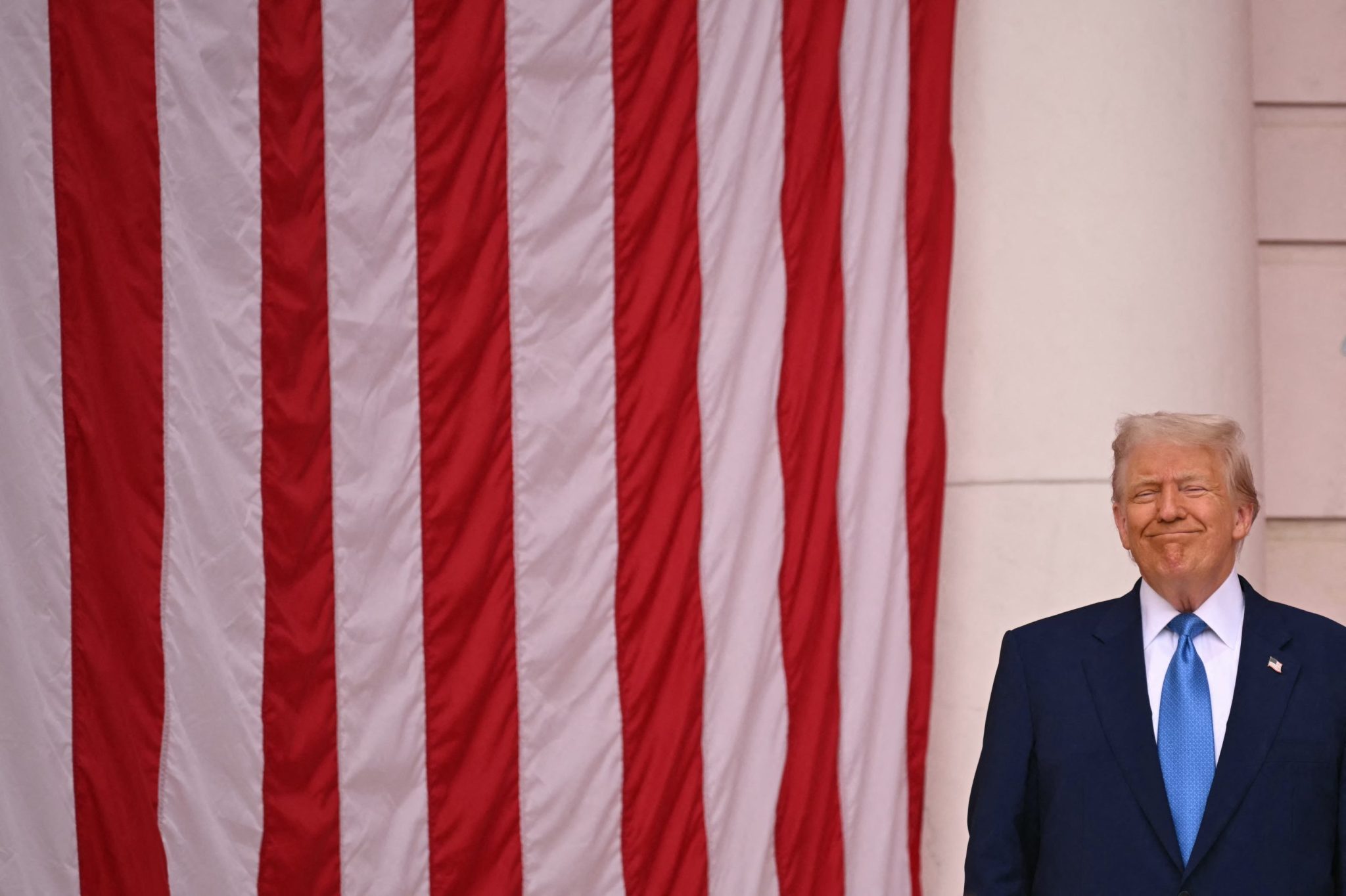

- Economic exception for a long time in AmericaIt was subjected to pressure in its size, stability and global confidence – due to the changeable policies of President Trump, which have introduced legal fluctuations and challenges, raising anxiety among analysts about the erosion of structural advantages of the United States. While some still view the United States as a safer investment destination, others warn that the brand of the nation and its ability to financing cheap in itself may suffer from long -term damage.

For many years, American economists have been able to ignore the worst scenario in periods Economic volatility thanks to their “exceptional” of their nation.

The “exceptional” situation in America is the belief that the largest economy in the world is uniquely perfect compared to others – and others – Both data and history provide strong support For the idea.

But the exceptional basis in America has long been its length, the size and stability of the United States, making it a safe port for assets at the time of global turmoil.

Since President Trump returned to the Oval Office, this stability does not seem guaranteed in the long run as before Deutsche Bank Analysts write that the exception may be the side damage in Trump’s attempts to rebalance.

“There is a growing feeling that we are now on a turbulent road, but we are continuing to cancel the escalation,” Jim Reed wrote this morning. luck. “Even if the American administration remains a trading, we have already seen that there are limits to this approach, especially in the face of market turmoil and low approval assessments of President Trump.

“So although we believe it is likely that there will be long and noticeable uncertainty in the United States’ growth on H2, the cancellation of the escalation so far will support growth for previous expectations.”

However, “” a lot of side damage has already happened. ”

The past few months have been rugged for markets at the very least, as they responded to the policy of rapid change with some of the main partners in trading and army in America.

To quickly summarize in the past few months, President Trump has entered the Oval Office and threatened the definitions of Mexico, Canada and China to push nations to curb migration and flow of fentian. The customs tariffs were stopped on Canada and Mexico shortly before the start of the implementation of about a month.

Trump also started advertising Sector definitions on products such as cars and steelWide -scale economic sanctions are described to be announced on April 2 or, as they were called, “Liberation Day”.

In early April, President Trump shocked the markets by announcing the customs tariff at the most extreme end of the spectrum, with a 10 % global rise in imports as well as huge increases on the likes of the European Union and China – all in the name of re -balance in trade. China has responded with its own measures, as the price warfare that saw an import tariff for Chinese goods was strengthened by 145 %.

Trump then delayed the majority of definitions on liberation day and separated all the sanctions to 10 % for 90 days, although he recently threatened and then re -directed the height of the European Union by 50 %.

While agreements were agreed with the likes of the United Kingdom in principle, the Trump team faced another setback last week after the court ruled A tariff day was illegal The White House told its removal, before this decision was quickly stopped in the Court of Appeal.

In this way, Reid wrote: “Our view argues that the structural institutions of the American exception – especially the ability to fund themselves cheaply by setting up the dollar reserves – started to wear. So we remain a structural decline on the dollar and expect to continue in the United States.”

Although eliminating investment in the United States may affect confidence in the long -term views, RIID indicates a short -term blessing of investors: risks. The fact that America can be seen as less than a safety net can provide greater returns for those who want to take opportunities.

Viktor Shvets, head of the Macquarie Capital strategy, believes that the American exception is eroded, but added: “We believe it is a process that is not a collapse, which creates an environment of gradual rise in American risks and avoiding the re -pricing of non -disciplined assets.

In joint observation with luck Yesterday, Shvets adds that Macquarie is still cautious about China’s ability to grow, but added that he expected to see a decrease in the country’s risk.

Betting against the United States

As part of the American exceptional, it will be offered pressure to find an analyst (despite current foreign policy fluctuations) will be completely betting on the success of the United States

As Jimmy Damon, Jpmorgan Chase CEO, recently Bloomberg saidIn his opinion, “If you will take all your money and put it in one country, it will remain America. I mean, it is still a more prosperous nation on this planet.”

He added: “The United States is still a more prosperous and innovative nation on this planet. This will not change.”

However, it seems that some of the most prominent names in Wall Street still are concerned about the long -term damage to feelings that the White House policy may have caused it.

Ken Griffin, founder and CEO of Citadel, also puts more than just a nation – it is a brand … We are eroding this brand now. ”

Speaking during the Global Economy Summit at Semafor earlier this year, he added: “In financial markets, the brand comparing the American Treasury brand cannot … we have endangered this brand.”

This story was originally shown on Fortune.com