The strategy publishes $ 14 billion in unreasonable gain in the second quarter

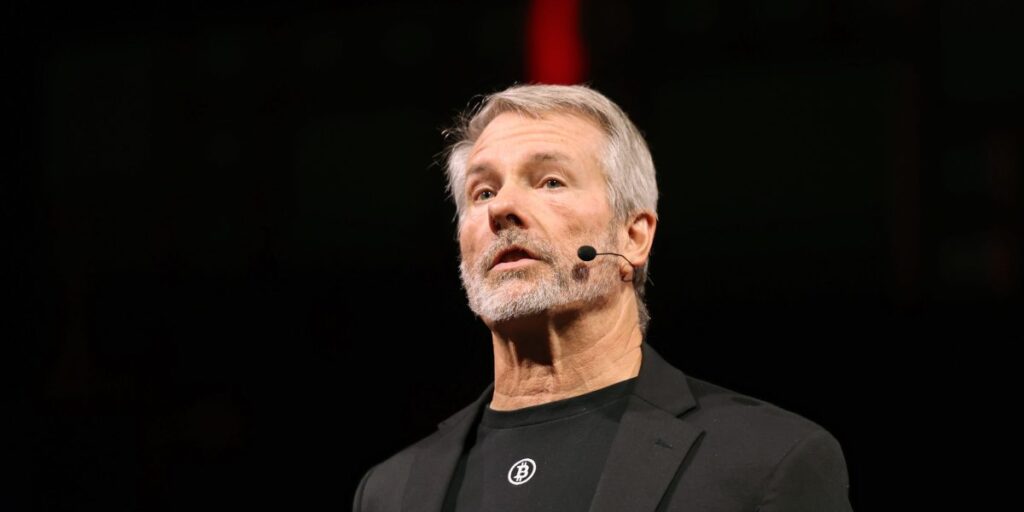

Michael Celor’s strategy recorded an unreasonable gain of $ 14.05 billion in the second quarter due to a recovery in Bitcoin price And changing modern accounting.

The company said in the deposit of the US Securities and Exchange Committee on Monday that the unreasonable gain had been partially compensated by deferred tax expenses of $ 4.04 billion. This is the first week in which the company was not previously known as Microstrate Inc. Additional symbols have been bought since April. The strategy has about $ 65 billion in Bitcoin, making it the largest carrier of companies in the encrypted currency.

Saylor has transformed the time of the founding institutions manufacturer once into the pioneering bitcoin agent by selling shared and favorite shares and debt offers. On Monday, it also announced the addition of a market sales program to the third round of the favorite shares that started selling earlier this year to help finance Bitcoin. The strategy received about $ 6.8 billion from Bitcoin in the three months ending June 30.

Although the quarterly results of the strategy will probably put it in a selected group with proverbs Amazon Company and Jpmorgan Chase & Co. Its operating profits are expected to exceed $ 10 billion in the last quarter, the company is expected to publish only about 112.8 million dollars from its software revenues, according to the analysts included in them. The company is expected to lead the results of the second quarter in August.

The strategy shares have increased more than 3,300 % since Sailor began buying Bitcoin in the middle of 2020 as a hedge against inflation. Bitcoin rose about 1000 % during the same period, while the S&P 500 increased around 115 %. The stock increased by 40 % in the second quarter with S&P up 11 %.

In the first quarter, the strategy adopted changing accounting, requires bitcoin evaluation of the company at market prices. The strategy and colleagues of the bitcoin company in Bitcoin now realize the unrealized changes that often produce significant fluctuations in profits. The strategy set a record $ 4.2 billion in the first quarter, which saw Bitcoin’s 12 % decrease.

Before changing accounting, the strategy was classified by bitcoin holdings, such as unfinished assets such as patents or brands. This strategic appointment forced to determine the value of its property permanently when the bitcoin price decreased below the previous book value. The gains can only be recognized when the symbols were sold.

(Adds information on weekly purchases and market sales, starting from the second paragraph.)